Epoch News

Immediate deductions extended

Temporary full expensing enables your business to fully expense the cost of: New depreciable assetsImprovements to existing eligible assets, andSecond hand assets in the first year of use. Introduced in the 2020-21 Budget and now extended until 30 June 2023, this...

Are your contractors really employees?

Two landmark cases before the High Court highlighted the problem of identifying whether a worker is an independent contractor or employee for tax and superannuation purposes. Many business owners assume that they will not be responsible for PAYG withholding,...

Professional services firms profits guidance finalised

The Australian Taxation Office’s finalised position on the allocation of profits from professional firms starts on 1 July 2022. The ATO’s guidance uses a series of factors to determine the level of risk associated with profits generated by a professional services firm...

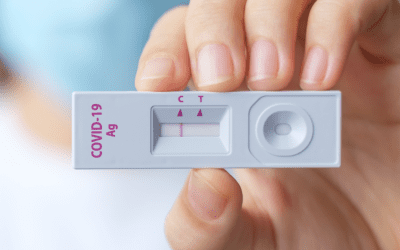

PCR and RAT tests to be tax deductible, FBT free

The Treasurer has announced that PCR and rapid antigen tests (RAT) will be tax deductible for individuals and exempt from fringe benefits tax (FBT) for employers if purchased for work purposes. There has been confusion over the tax treatment of RAT tests with the...

Year of the Tiger: Roaring of Bellowing?

The 2022 Luna New Year, Year of the Tiger, is courage and bravery. It is a year to drive out evil and one of momentum and change. The message - walk boldly with courage. And it seems the Reserve Bank Governor is aligned with this sentiment. The Tiger economy At a...

Year of the Tiger: Roaring of Bellowing?

The 2022 Luna New Year, Year of the Tiger, is courage and bravery. It is a year to drive out evil and one of momentum and change. The message - walk boldly with courage. And it seems the Reserve Bank Governor is aligned with this sentiment. The Tiger economy At a...

2022: The year ahead

2021 was supposed to be the year we returned to a post-COVID normal. However, the pandemic has fundamentally changed the way many of us operate in our personal and work lives. Here is some of what we can expect in 2022: Federal Election The Federal election will...

The top Christmas tax questions

Every year, I am asked about the tax impact of various Christmas or holiday-related gestures. Here are the top issues: Staff gifts The key to Christmas presents for your team is to keep the gift spontaneous, ad hoc, and from a tax perspective, below $300 per person....

If Santa was an Australian tax resident

A lighter look at the complexity of Australian taxation laws and the year that has been. Dear Mr Claus, Thank you for the opportunity to provide strategic business, tax and compliance advice for your operation. I’m pleased you have initiated this advice as the...

Overseas gifts and loans in the spotlight

The Australian Taxation Office (ATO) has recently issued an alert on gifts or loans from overseas. The ATO is particularly concerned about schemes and arrangements explicitly designed to circumvent Australian tax laws. In general, Australian-resident taxpayers need to...